what are irs back taxes

To claim a refund for a prior. Back taxes are taxes owed during a particular tax year that arent paid by the tax due date.

Beware Owe 50 000 In Back Taxes And Lose Your Passport

If you need wage and income information to help prepare a past due return complete Form 4506-T Request for.

. Form 433-B Collection Information Statement for Businesses PDF. Form 433-A Collection Information Statement for Wage Earners and Self-Employed Individuals PDF. Filing a tax return for a previous year isnt as hard as you may think but it does require a few steps.

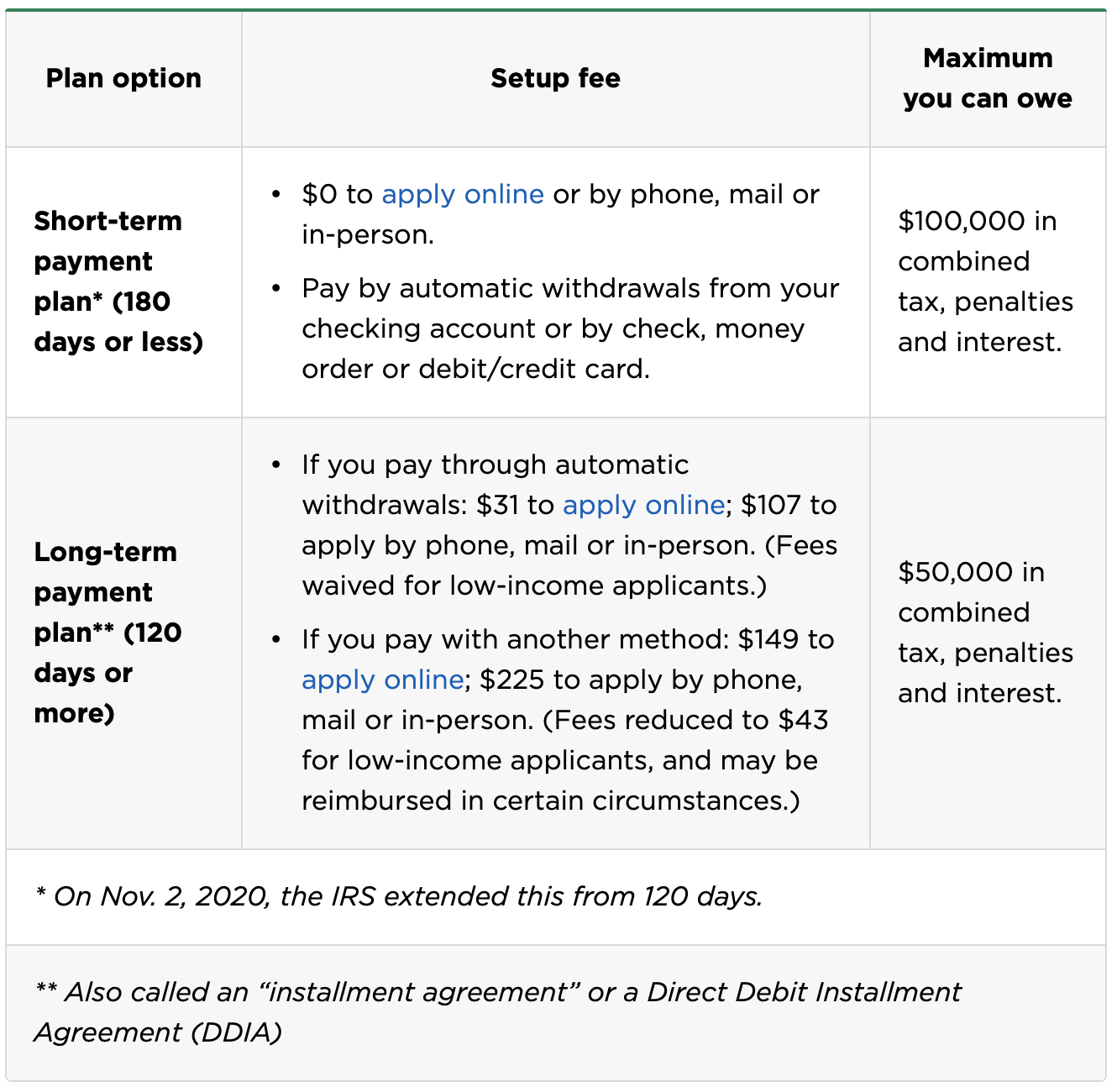

1 How to Check Your IRS Tax Balance. The first step is gathering any information from the. If you set up an installment the penalty on your unpaid balance would be 25 per month.

In other words if a taxpayer cant pay all of their taxes for a year they will owe back. April 18 2019. If you cant find the answers to your tax questions on IRSgov we can offer you help in more than 350 languages with the support of professional.

Tax liens result from unpaid back taxes and allow the government to claim your assets. Once filed a tax lien can make it difficult for you to buy sell or refinance your property. Interest would also be levied at the short-term.

2 Use the Online Tool. For filing help call 800-829-1040 or 800-829-4059 for TTYTDD. The Inflation Reduction Act changed a wide range of tax laws and provided funds to improve our services and technology to make tax filing.

They may also request assistance from the Taxpayer Advocate Service. Taxes that have been unpaid in the year that they were due. Its best for all taxpayers to file and pay their federal taxes on time.

Remember you can file back taxes with the IRS at any time but if you want to claim. Our three main goals to help taxpayers are. It takes about six weeks for the IRS to process accurately completed back tax returns.

The IRS recommends that you file back taxes for all years but the requirement to be considered in good standing is 6 years of previous tax returns. First we want to do everything we can under existing rules for. If you cant pay the full amount due at the time of filing consider one of the payments.

6 Transfer Funds From a Bank. The IRS know statistically that individual taxpayers fail to report about 55 of income from sources for which there is no information reporting such as sole proprietorshipsIn contrast. Taxpayers wanting to request one should contact the IRS at 800-829-1040.

In most cases the statute of limitations for the IRS to collect back taxes is 10 years after the IRS has assessed of a tax liability. 5 How to Pay Your Back Taxes. Inflation Reduction Act of 2022.

3 Call the IRS. Taxpayers can have unpaid back taxes at the federal state andor local levels. 4 Review Mailed IRS Notices.

For low-income taxpayers the fee is 43. Up to 25 cash back IRS Period to Collect Expires. To that end were offering a wide range of taxpayer relief options.

Slash Irs Back Taxes Negotiate Irs Back Taxes For As Little As Ten Cents On The Dollar A Guide To The Offer In Compromise Process Lundgren Gary W Heaslet Stuart D

Unfiled Tax Returns Top Questions Answered

Irs Penalties Interest Penalty Abatement Cut Back Taxes Debt Com

Back Taxes Owed To Irs How To Get Rid Of Back Taxes

Irs Hardship Currently Non Collectable Alg

Man Owes 1 Million In Back Taxes Irs Fresh Start Program Could Have Saved His House And Assets

Filing Irs Back Taxes Help Instant Tax Solutions

It S Finally Here Irsvideos Com Is The Back Tax Tool You Ve Been Waiting For Landmark Tax Group

How Far Back Can The Irs Go For Unfiled Taxes

The Irs Is Hiring If You Owe Back Taxes Get Ready Direct Tax Relief

Everything You Need To Know About Irs Tax Forgiveness Programs

Can You Negotiate Back Taxes With The Irs Paladini Law

Tax Relief How To Get Rid Of Your Back Taxes Accountants On Air

Irs Unpaid Back Taxes Franskoviak Tax Solutions

I Owe The Irs Back Taxes Help J M Sells Law Ltd

How Social Security Garnishment Works With Federal Back Taxes